DO YOU KNOW WHAT YOUR INVESTMENTS ARE FUNDING?

The reality is that it is pretty unlikely you really know what your investments are funding. Given the huge scope and size of most publicly traded companies, it is difficult for the average investor to know all the lines of business they engage in and where their corporate giving is directed to.

That may mean that indirectly (and unintentionally) you are providing them with capital that they spend on causes which you would never support if you knew about it.

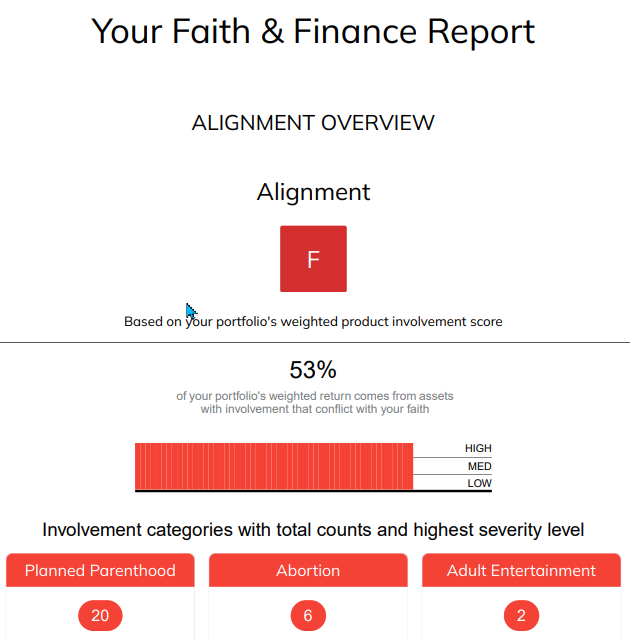

This is where Aquinas Wealth and their Faith & Finance Score come in. We provide you with the transparency to see what investments are contributing to and how it aligns with traditional catholic values.

But we don’t stop there, when you work with Aquinas Wealth we help you realign your portfolio to investments that do align with your values while still working to achieve your financial goals.

Why Work With Aquinas Wealth Advisors

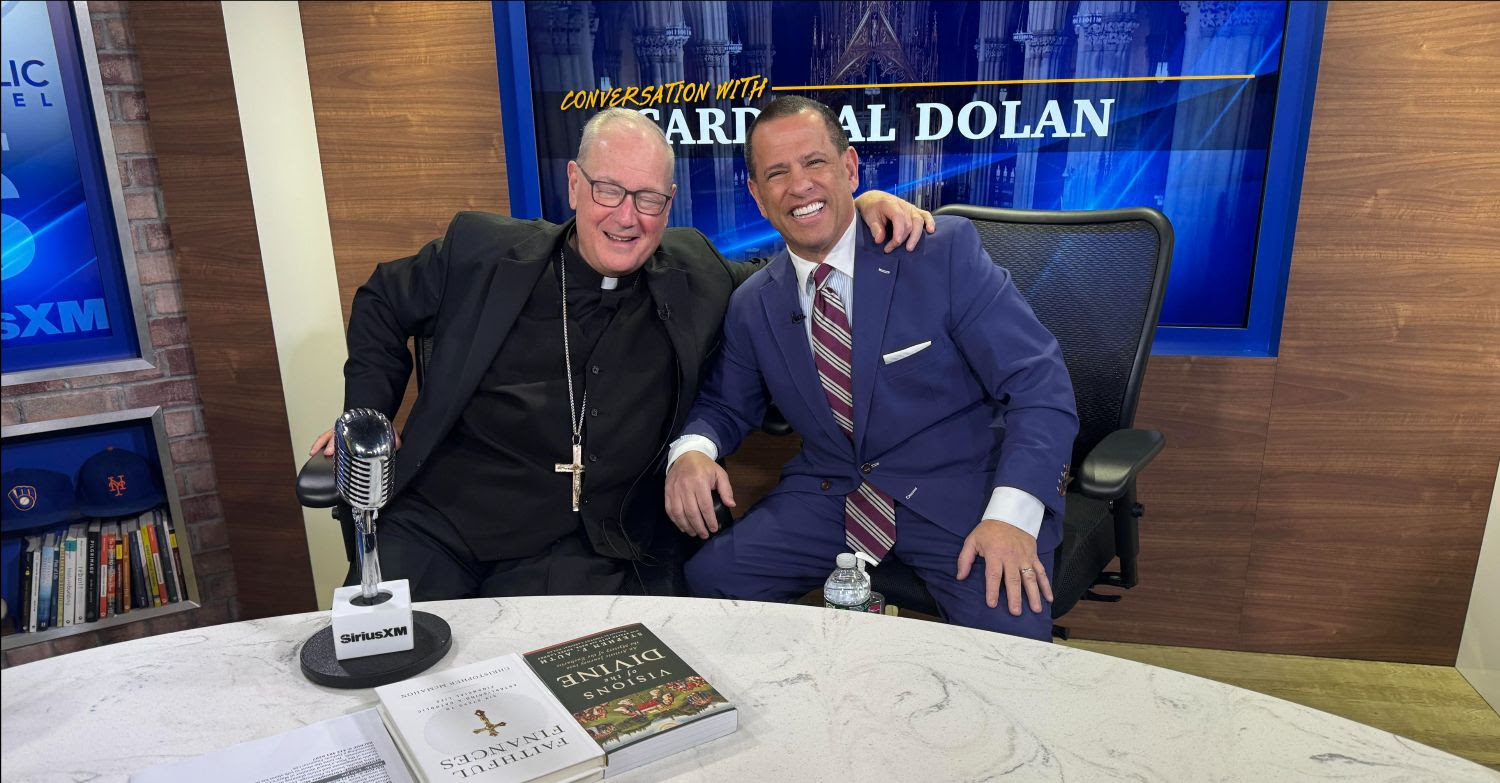

Learn more about how Aquinas Wealth Advisors can help you align you faith with your finances. Hear more about the planning that we do and how our tech savvy approach brings solid returns while providing morally sound investments.

WHEN YOU PUT YOUR CONFIDENCE IN AQUINAS WEALTH ADVISORS, YOU’LL BENEFIT FROM:

01

Transparency in your investments’ corporate activities

02

A comprehensive values-based planning process

03

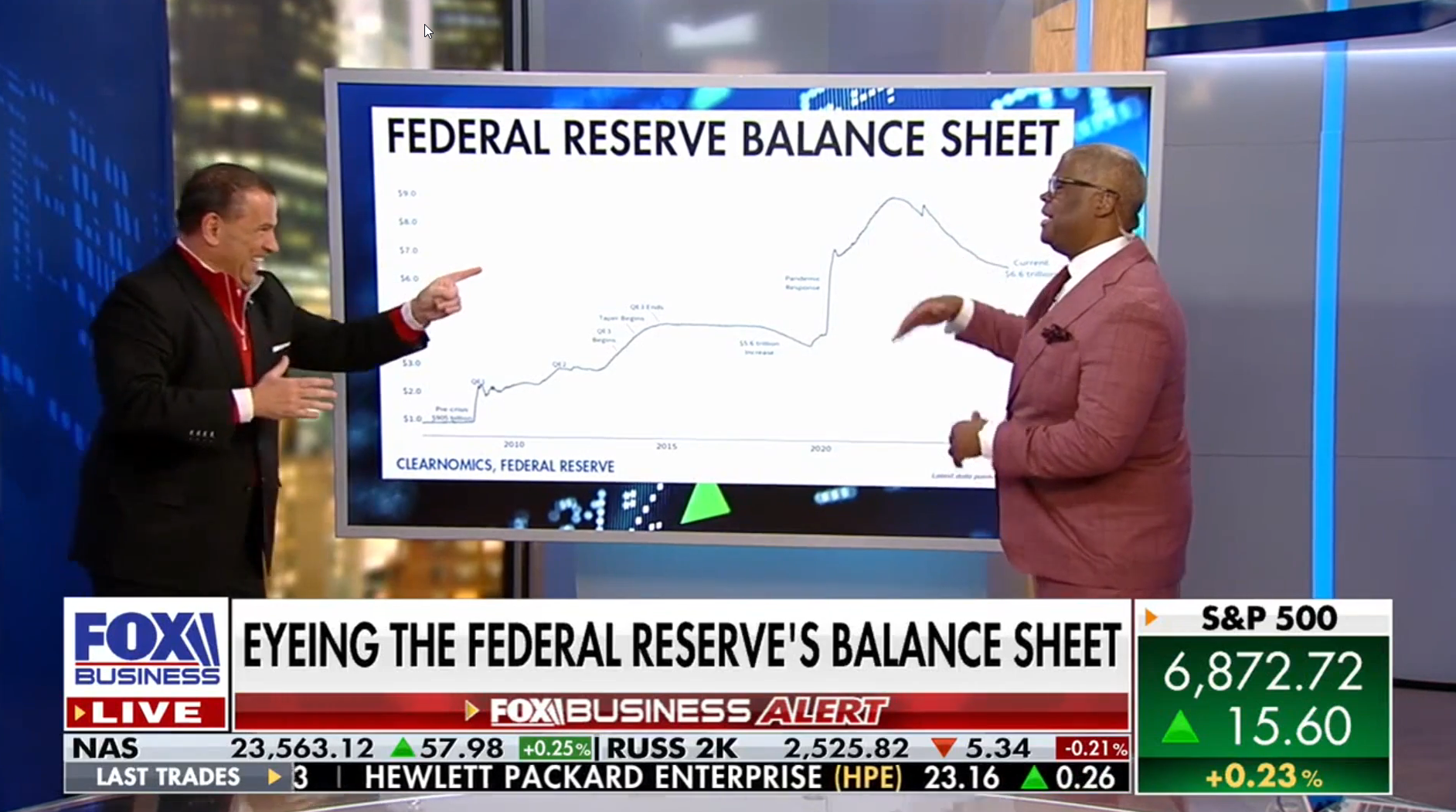

Tech-smart portfolios that aim to manage your funds strategically and efficiently

04

Financial planning that can take into account your complete financial picture

05

The convenience of having all your accounts in one place

06

Working with a fiduciary that works in your best interest

5 Questions that Matter with Father Mike Schmitz

All new episode of 5 Questions That Matter featuring a conversation with Father Mike Schmitz. He is the host of the widely popular podcasts, “Bible in a Year” and “The Catechism in a Year”. Check out his interview with Chris McMahon from Aquinas Wealth.

5 Questions that Matter

- How do we keep the energy from the Eucharistic Congress going? What’s our next step?

- How do we help remind people of the beauty of our church? How do we take this good news and bring it into people’s lives?

- Do you think it is important for us to live our faith out in public? To take it beyond our Sunday mass?

- People say we love Father Mike’s Ministries but they also want to know how can we best help you advance your work?

- What do you use personally for joy? What would you recommend to us in that search for joy or achieving a joyful life?

Want to see more? Check out all the 5 Questions That Matter Interviews here.

HOW TO GET STARTED

GET YOUR FAITH & FINANCE SCORE

View a sample score, unveil your personal score, or schedule a call with a team member.

LEARN MORE